1. Introduction: Empty Highways

"The most valuable part of blockchain might be its unused capacity."

Today, the world's major blockchains are cumulatively operating at just 1% of their capacity1. But what if I told you the most valuable part of blockchain might be the other 99% - and unlocking it could create trillions in value?

Zombie Chains

Forbes recently highlighted an uncomfortable truth: many blockchains with multi-billion-dollar valuations are generating just tens of thousands in fees. They called it the 'zombie blockchain problem'.

They're right about the numbers - but they're missing something crucial. Instead of viewing these empty networks as failures, we should see them as part of a larger infrastructure wave being built for the future - economic highways purpose-built to securely carry and settle the world's wealth and data.

We've constructed information superhighways for value, but today most lanes remain empty. These unused roads might be exactly the foundation we need for tomorrow.

Infrastructure leads to Innovation

a16z’s Chris Dixon has drawn parallels between today's blockchain infrastructure boom and the over-investment in bandwidth during the dot-com era.

The main point he makes will be familiar to anyone who has read Perez’s Technological Revolutions and Financial Capital: that over-investment in infrastructure during a hype cycle lays the foundation for future innovations.

There is plenty of analysis comparing internet user adoption to crypto user adoption. However, a gap exists in looking at this through the lens of infrastructure.

I set out to address this void, to go under the hood and leverage historical reports and on-chain data to broadly quantify blockchain under-utilization and draw informed parallels with early internet infrastructure.

This piece aims to:

Explain blockspace using clear analogies

Draw parallels with the dot-com era's bandwidth boom

Quantify the current state of blockchain utilization

Explore the possibilities of this excess capacity for future innovation

By looking at historical patterns and current data, we'll provide a roadmap for understanding where we are and the potential that lies ahead.

2. What is Blockspace?

Before we dive in, it’ll be helpful to have an idea of what blockspace is.

Blockspace refers to the capacity of each block in a blockchain to contain transaction data. Simply put, blockspace tells us how much information can be transmitted in each block that gets added to a blockchain.

It represents the limited resource of transaction processing capacity in a blockchain network, analogous to bandwidth in traditional data transfer. This capacity directly impacts the network's throughput, fees, and ability to handle various types of transactions or smart contract operations.

Digital Value Highways

To intuitively understand blockspace, think of blockchains as digital value highways. Just as highways carry vehicles of different sizes - from motorcycles to large trucks - blockchains carry different types of instructions, from simple payment transfers to complex smart contract interactions. To get onto the highway, all traffic must pass through and pay a fee to a toll booth, which checks their registration number.

In order to add a block to a blockchain, all the instructions must pay a fee to the network which checks if the instruction is valid. Certain instructions take more space, like smart contract deployments. Like trucks, these will take up more room at the toll booth, leaving less available space for other instructions trying to get processed.

Just as highways have a maximum number of vehicles they can handle, blockchains have a theoretical maximum throughput. This capacity - how much transaction "traffic" can flow onto the highway in a given time - is what we call blockspace.

Non-Fungible Highways

On a blockchain, the data needed to transfer a billion dollars will take up roughly the same space as transferring a single dollar. But if you’re the one sending a billion dollars, how do you make sure it stays safe?

This is where an important distinction comes in: unlike traditional bandwidth, blockspace is not fungible across different networks. Think of different blockchain networks as different types of highways:

Some are like multi-lane freeways, processing transactions quickly but with less security (a highway with many lanes but fewer checkpoints).

Others are like secure single lane armored vehicle routes with heavy tolls (slower and more expensive, but more secure for high-value transfers).

Because blockspace isn’t fungible, it makes it more difficult to compare across networks. For instance, Ethereum's high-fee, high-economic security, low-throughput model contrasts sharply with Aptos’s lower-fee, lower-economic security, higher-throughput structure.

But now that you have the highway analogy in your head, you’ll be able to understand the issues that pop up when we start our comparison.

Before comparing across blockchain networks, let’s first draw lessons from the past and make a historic parallel. To gain deeper insights into blockchain’s current state and future potential, we’ll briefly visit the dot-com era infrastructure boom and understand how it played out.

3. Historical Parallel: The Dot-Com Bandwidth Boom

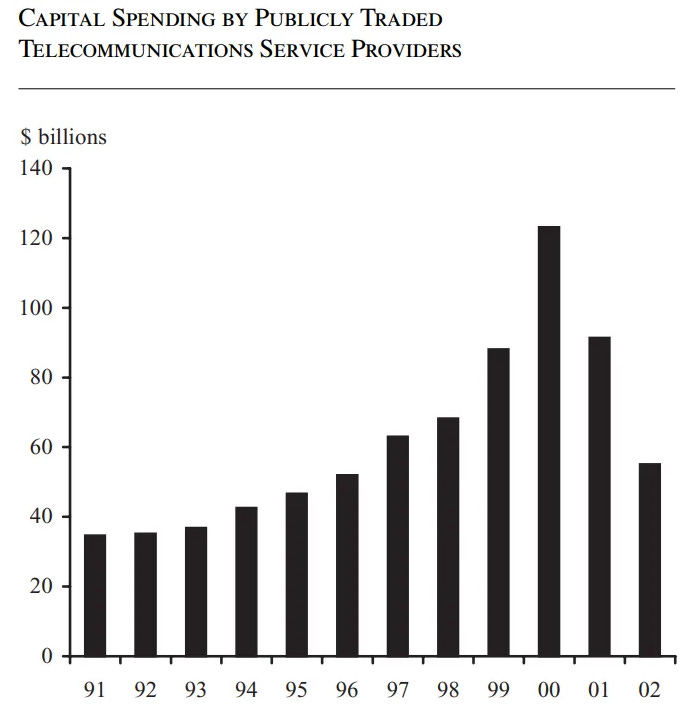

In the late 1990s, the internet was the new frontier, and bandwidth was a precious resource. Telecommunications companies, fueled by $1.6 trillion in equity capital raised from investors and another $600 billion in bonds, embarked on an epic infrastructure spending spree2:

Between 1996 and 2001, over $500 billion was poured into new networks.

More than 80 million miles of optical fiber were laid - enough to circle Earth 3,200 times.

This frenzy was fueled by wildly optimistic projections that internet traffic would double every 100 days (The source of those predictions appear to have come directly from telecom execs3. Talking your own book transcends industries and eras).

The result? A massive increase in capacity.

But then reality struck. The bubble burst and by 2002, an estimated 97% of laid fiber remained "dark" - unused and waiting4.

The parallels are striking. Just as the dot-com era saw massive investment in fiber optic infrastructure, we’ve been witnessing huge capital flows into blockchain Layer 1’s and Layer 2’s. According to Rootdata, over $12bn has been raised for L1’s and L2’s to date5. But how much actual usage is there today?

4. Blockspace: The New Frontier

To answer this question let's examine the current state of our blockchain highways.

To quantify the current state of blockchain utilization, I focused on a sample of 21 major blockchain networks6, selected based on the overlap of data from two independent sources7, comparing different blockchain networks’ theoretical capacity to actual usage.

It's important to note that the resulting figures should be viewed as directionally accurate rather than precise measurements. This sample provides a helpful benchmark for understanding the current state of blockchain utilization but aren’t truly accurate figures, as there are estimated to be over 1000 different blockchains.

If you are interested in the methodology, I’ve made a footnote with more details8.

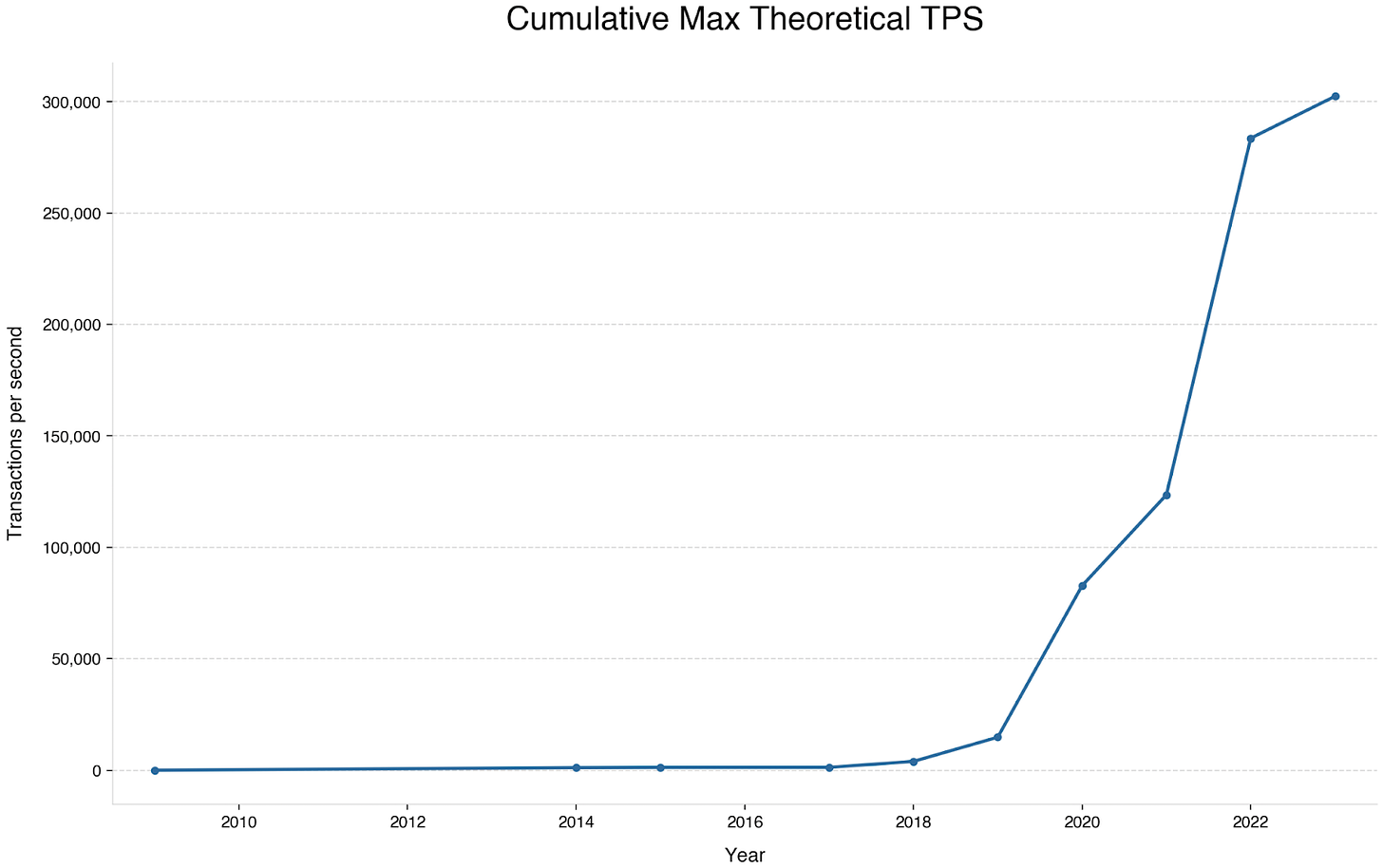

Blockspace Growth9

Great! We have lots more capacity than before, with a 300x increase since 2017. But now let’s look at how much of that is being used.

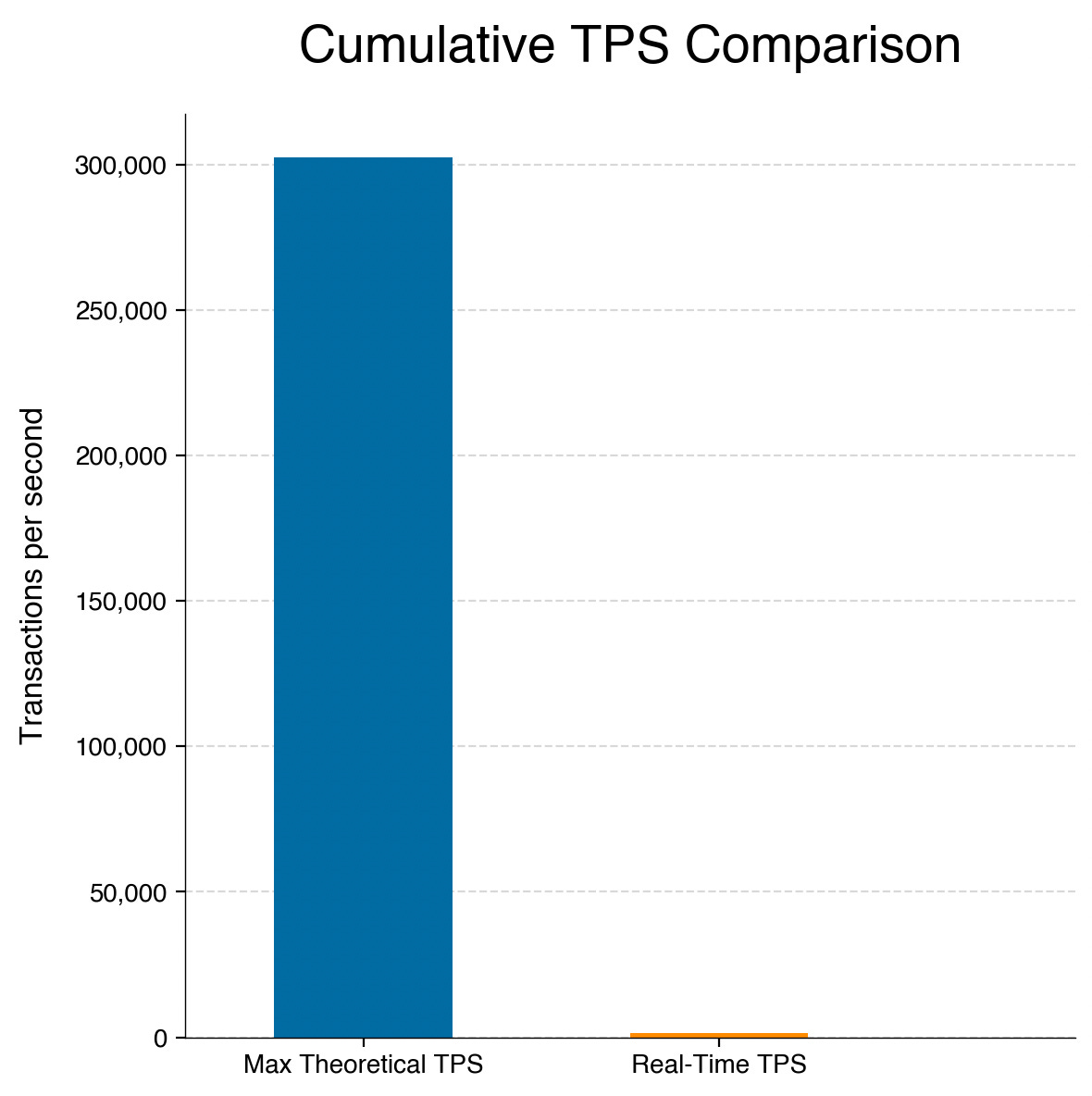

Blockspace Usage10

Most of the theoretical capacity that is being added is sitting idle, with actual usage at 1% of cumulative capacity.

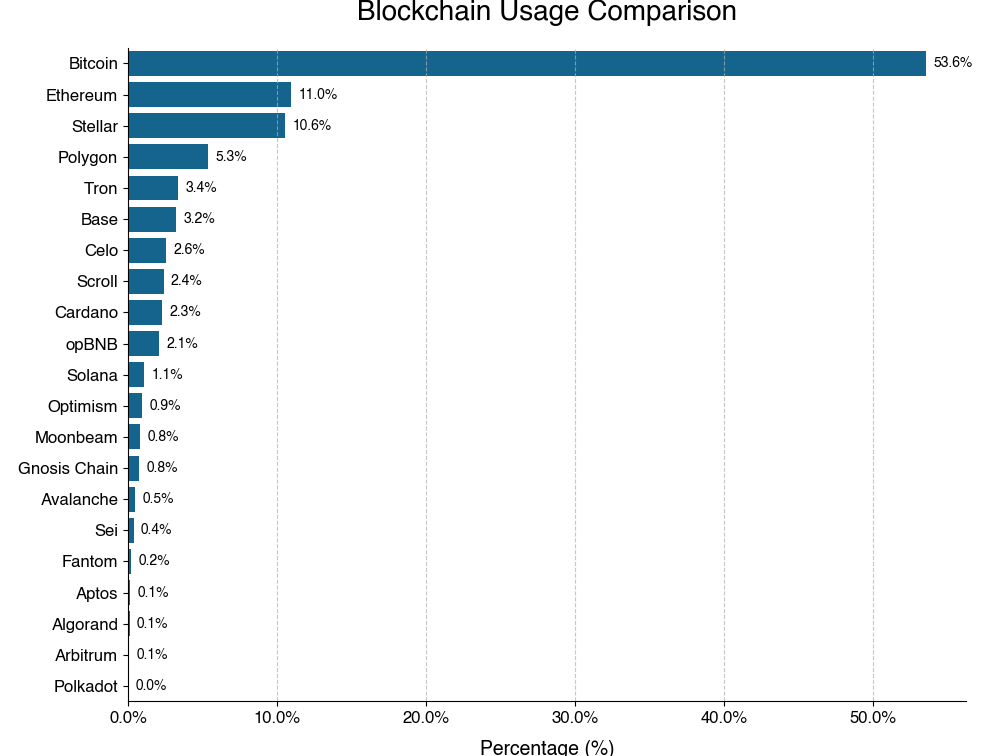

Armored Vehicle Lanes vs Multi-Lane Highways11

Let's revisit our highway analogy. The established secure lanes - networks like Bitcoin and Ethereum - see heavy traffic. Meanwhile, newer high-speed highways built for massive throughput sit largely empty, their lanes ready but waiting for traffic.

This concentration of activity on established networks, despite faster alternatives, highlights a key difference from the early internet era: in blockchain, security and network effects often outweigh raw speed. Just because new networks are available doesn’t mean they are yet trusted. Like any critical infrastructure, these new highways must prove their reliability before wide-spread use.

Comparison With Dot-Com

Comparing this data to internet bandwidth utilization from the late 90s and early 2000s reveals a striking similarity:

2000: Usage dropped to ~3% after massive infrastructure buildout12.

2024: Most blockchains operating below 5% capacity.

These low utilization rates across most blockchain networks suggest we're in a phase of overbuilding similar to the early internet.

The roads have been laid, we’re now waiting for the drivers.

5. The Value of Unused Capacity

At first glance, all this unused capacity might seem wasteful. Are the critics right? Have we created elaborate castles in the sky whose halls will remain forever empty?

Before judging, it’s helpful to look at the aftermath of the dot-com bandwidth boom and think about what rhymes history might reveal to us.

Web2: The Phoenix from the Dot-Com Ashes

We left the dot-com era as it collapsed, with millions of miles of newly laid fiber optic cable lying dark. But it didn’t stay that way forever.

The surplus capacity and the fall in costs allowed the next wave of entrepreneurs and developers to create transformative new industries, enabled by abundant, cheap bandwidth.

Some Examples:

Social Media: Platforms like Facebook leveraged excess capacity to allow easy photo and media sharing. Today Facebook has over 3bn monthly active users13.

Video Streaming: Netflix and YouTube now account for a significant portion of global internet traffic. Today video accounts for 65% of all internet traffic14.

Cloud Computing: Services like Amazon Web Services, built on excess capacity, now store most of the world's data. As of March 2023, AWS S3 holds more than 280 trillion objects in storage15.

The internet highways are now filled with traffic, its vehicles essential to our daily lives. Today we couldn’t imagine living without these innovations which only became possible because of the huge investment in internet infrastructure.

Blockchain’s Future

In the blockchain world, this unused capacity could enable similarly transformative applications. Just as excess bandwidth enabled Web2, excess blockspace could catalyze innovations we can't yet imagine.

This capacity can open up blue ocean territory, where old industries are ripe for disruption and new ones can be created from scratch.

However, challenges remain. While infrastructure is necessary, it's not sufficient alone. The early internet benefited from little initial regulatory oversight as it primarily dealt with communication and media. The blockchain world has found initial market fit with financial applications which have strict regulation and oversight. Existing regulation often doesn’t quite fit this new technology and regulators have been slow to adapt, preventing major institutional players from fully adopting it. This regulatory uncertainty prevents movement and stifles innovation.

This uncertainty is starting to resolve, with different regions around the world bringing in new regulations that address it head on. Clarity will allow institutional and enterprise adoption, which will allow many more resources to pour into the sector, sparking innovation which now has much higher blockspace capacity to work with.

6. Paving the Digital Highways of Tomorrow

“The bear case for blockchain is better settlement rails for finance. The bull case is new design space, entirely new industries being created we hadn’t even thought of before.”

- paraphrased from Hart Lambur16

We’ve been building blockchain highways at a breakneck pace, but most lanes are sitting empty. It's easy to criticize and decry ‘zombie chains’. But remember - we've seen a similar story play out before, and it led to a revolution in how we communicate, work, and live.

Just as excess bandwidth paved the way for streaming and social media, today's abundant, cheap blockspace is quietly laying the foundation for Web3's future “killer apps”. We can't predict exactly what they'll be - it would have been difficult in 1999 to forecast TikTok. But the potential is enormous.

Tying it up

Let’s revisit the statement made at the start of the article.

What if I told you the most valuable part of blockchain might be its unused capacity.

Hopefully this seemingly counterintuitive idea now makes sense. We’re still in the early days of an industry which is laying a new financial backbone for the digital economy. Just as the internet's unused capacity in the late '90s held the seeds of today's digital giants, blockchain's current excess capacity represents vast, untapped potential.

Looking at the historic parallel, the value created from what came after the dot-com era dwarfed what came before.

The unused capacity of blockchains, if harnessed effectively, has the potential to create value that far exceeds the current crypto industry - from streaming salaries paid by the second to automatic micro-insurance claims, decentralized AI training markets, real-time supply chain verification and more.

The digital highways of tomorrow are being paved today. The future will belong to those who build on them.

Thanks to David Schwed, Alex LaBossiere, Felix Stocker, Robert Martin and Charlie Curnin for reviewing drafts of this piece and providing feedback.

Across a sample of 21 major networks taken for this article.

https://ideas.ted.com/an-eye-opening-look-at-the-dot-com-bubble-of-2000-and-how-it-shapes-our-lives-today/

https://www-users.cse.umn.edu/~odlyzko/doc/itcom.internet.growth.pdf

https://www.wsj.com/articles/SB1032982764442483713

https://www.rootdata.com/Fundraising

List of Blockchains used: 1. Algorand 2. Aptos 3. Arbitrum 4. Avalanche 5. Base 6. Bitcoin 7. BNB Chain (Binance) 8. Cardano 9. Celo 10. Ethereum 11. Fantom 12. Gnosis Chain 13. Moonbeam 14. Optimism 15. Polygon 16. Polkadot 17. Scroll 18. Sei 19. Solana 20. Stellar 21. Tron

Big thanks to Sonarverse and Chainspect

Notes on Methodology

Transactions Per Second (TPS) is widely used by blockchains to describe their speed and capacity. This is a non-standardized method as average transaction size can and does differ across different networks. This thread expands on a few reasons why TPS is a poor metric. The easiest way to standardize TPS would be to take the average transaction size in bytes and multiply it by TPS to get a standardized “Data Transfer Per Second”. However, while TPS stats are easily accessible, unfortunately average transaction sizes are not.

I was unable to find data for all the chains in this sample. The data I was able to find had average transaction sizes in bytes between ~200-400 bytes. This suggests that they all are in the same order of magnitude and that the “Data Transfer Per Second” figure would be roughly similar to the TPS figures shown.

If you have detailed data on average data transferred per transaction across networks, please reach out! I’d love to have more accurate figures.

—

Note on Calculation of Each Figure

Figure 1: Cumulative Sum of Max Theoretical TPS. Summation based on year of launch.

Figure 2: Max Theoretical TPS vs Real Time TPS. Real Time TPS Data taken over 30 day window in September 2024.

Figure 3: Max TPS/Real Time TPS. Real Time TPS Data taken over 30 day window in September 2024. Note: Most data was from Chainspect and cross checked with Sonarverse. However, Chainspect has an issue with Bitcoin Real Time TPS being greater than Max Theoretical TPS. As such the figure for Bitcoin usage was taken from Sonarverse over September using slightly different methodology.

—

https://www.wsj.com/articles/SB1032982764442483713

https://sproutsocial.com/insights/facebook-stats-for-marketers/

https://www.tubefilter.com/2023/01/20/sandvine-video-data-bandwidth-internet-traffic-report-streaming-video-youtube-netflix/

https://www.allthingsdistributed.com/2023/07/building-and-operating-a-pretty-big-storage-system.html

https://blockworks.co/podcast/bellcurve/3ba8bf64-bf20-11ee-b0d3-f71750d7c2be